Updated on April 22, 2024

A New Jersey registered agent is an individual or a corporation responsible for receiving official documents on behalf of a corporation. Either type of agent must have a New Jersey address. Every corporation organized in New Jersey is required to continuously maintain a registered agent.[1]

Top Registered Agents (7)

| Company | Price ($) | Document Scanning | Agent Change Fee | Annual Renewal Fee | Mobile App? |

| *ZenBusiness 4.7 out of 5 – 13,467 reviews | $99/year | Yes | $0 | $0 | iOS | Android |

| Incfile 4.7 out of 5 – 15,944 reviews | $119/year | Yes | $0 | $0 | – |

| Harbor Compliance 4.0 out of 5 – 17 reviews | $99/year | Yes | $50 | $0 | – |

| Northwest Registered Agent 3.5 out of 5 – 62 reviews | $125/year | 15/year | $0 | $0 | – |

| InCorp Services 2.2 out of 5 – 16 reviews | $129/year | Yes | $0 | $49 | iOS |

| CT Corporation 1.8 out of 5 – 17 reviews | $354/year | Yes | $0 | $0 | – |

| New Jersey Registered Agent 0 reviews | $49/year | Yes | $0 | $0 | – |

*We collect affiliate fees from this company. Pricing is $99 for the first year and $199 for renewal.

Registered Agent Search

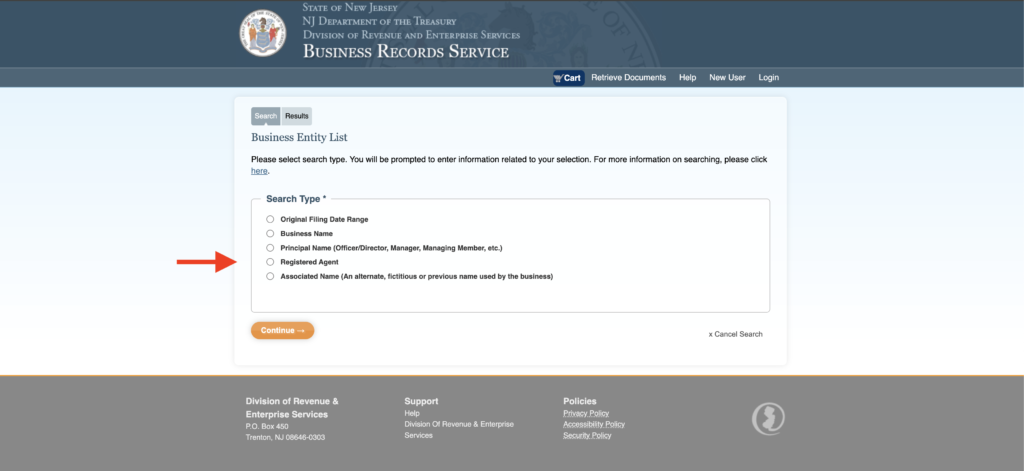

Step 1 – Visit the Business Entity List platform on the Division of Revenue and Enterprise Services website. Select “Registered Agent.”

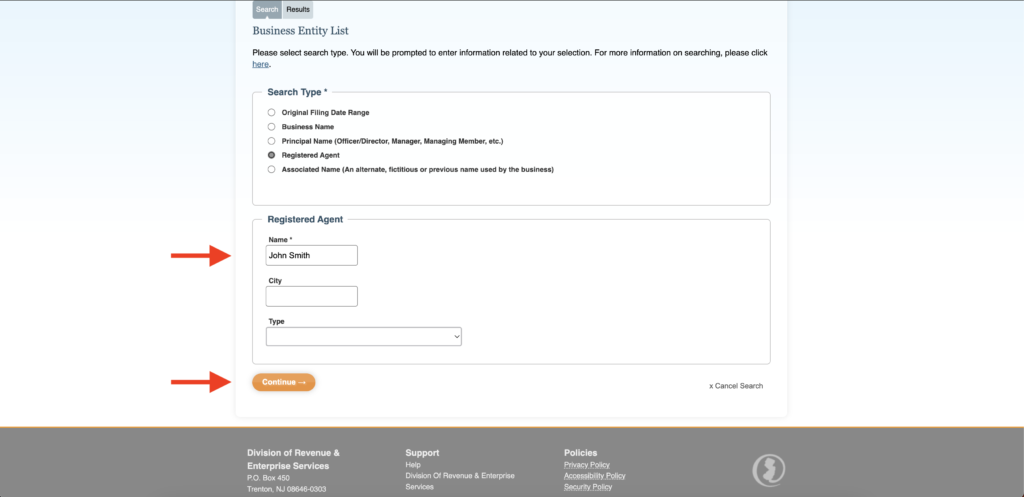

Step 2 – Enter the agent’s name. Click “Continue.”

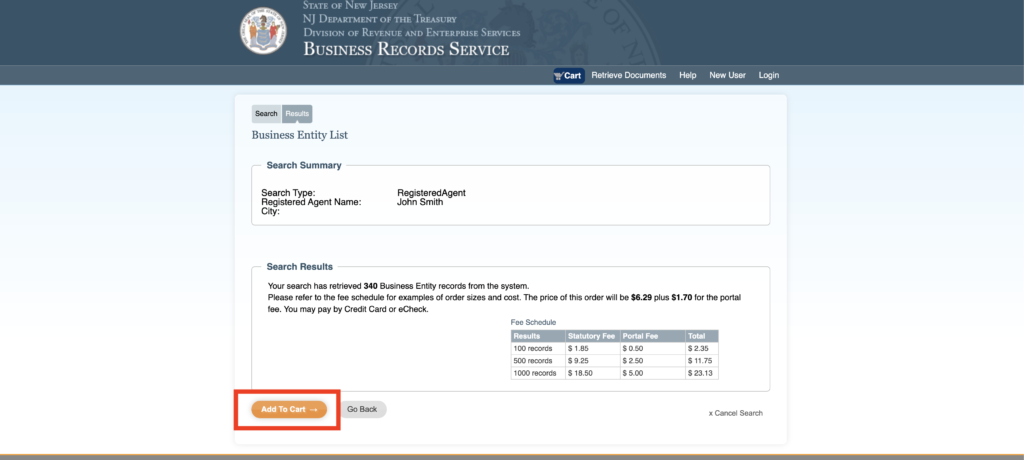

Step 3 – Searching for a registered agent in New Jersey is not free. The system will charge you depending on how many results the database retrieves. The total for 100 records is $2.35. Five hundred records cost $11.75 and 1,000 records cost $23.13. To access results, click “Add to Cart.”

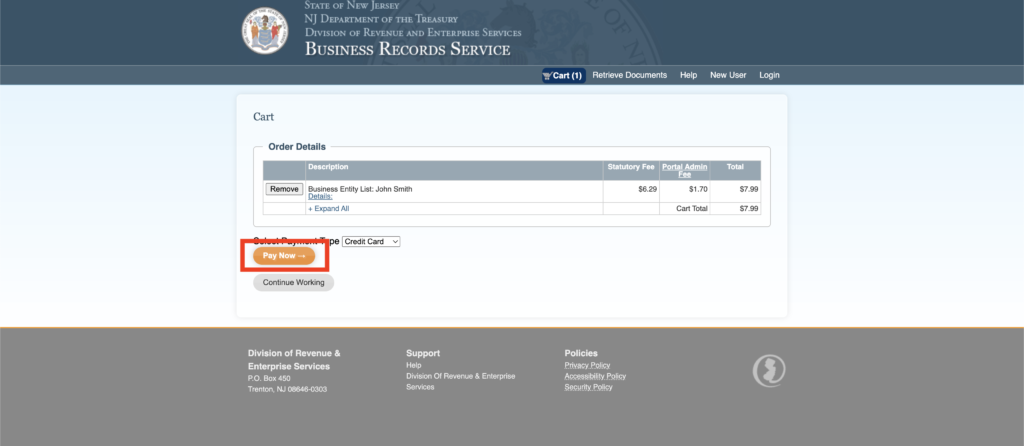

Step 4 – Select “Credit Card” and click “Pay Now.”

Who can be a Registered Agent?

Designating a Registered Agent

The most common way corporations designate a registered agent is to include the agent’s name and address in their formation document. In New Jersey, businesses are registered online.

The first step to registering a business is obtaining an employer identification number (EIN) from the IRS, which will be required in the online filing process. The next step is to visit the state’s business formation portal. Choose the type of entity, enter a name, and click “Continue.” The filing fee is $125 for all entities except domestic non-profit organizations, which carry a $75 filing fee.[2]

Changing a Registered Agent

To change its registered agent, a corporation must file a Certificate of Change with the Secretary of State. Twenty days before filing this document, the corporation is required to provide written notice of the change to its board. The change becomes effective upon filing or at a later date indicated in the certificate. A later date must be no more than 30 days after the date of filing.[3]

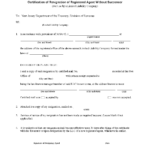

Certificate of Change

Certificate of Change

Download: PDF

Resigning as a Registered Agent

A registered agent may resign by sending a completed Certificate of Resignation by certified mail to the president, vice president, secretary, or treasurer of the corporation the agent represents. The certificate must be accompanied by either an affidavit of service or a written explanation of why service cannot be made.

A copy of the notice and the affidavit must then be filed with the Secretary of State.[4] The resignation becomes effective 30 days after this filing is made or when the corporation designates a new registered agent.

Certificate of Resignation

Certificate of Resignation

Download: PDF