Updated on February 27, 2024

A Minnesota registered agent is a person or corporation domiciled in the state that acts as a legal point of contact for a corporation. The agent is responsible for receiving official documents on the corporation’s behalf. Every business must have one.[1]

Top Registered Agents (7)

| Company | Price ($) | Document Scanning | Agent Change Fee | Annual Renewal Fee | Mobile App? |

| SunDoc Filings 4.8 out of 5 – 3,542 reviews | $159/year | Yes | $0 | $0 | – |

| *ZenBusiness 4.7 out of 5 – 13,467 reviews | $99/year | Yes | $0 | $0 | iOS | Android |

| Incfile 4.7 out of 5 – 15,944 reviews | $119/year | Yes | $0 | $0 | – |

| Harbor Compliance 4.0 out of 5 – 17 reviews | $99/year | Yes | $50 | $0 | – |

| Northwest Registered Agent 3.5 out of 5 – 62 reviews | $125/year | 15/year | $0 | $0 | – |

| InCorp Services 2.2 out of 5 – 16 reviews | $129/year | Yes | $0 | $49 | iOS |

| Minnesota Registered Agent 0 reviews | $49/year | Yes | $0 | $0 | – |

*We collect affiliate fees from this company. Pricing is $99 for the first year and $199 for renewal.

Registered Agent Search

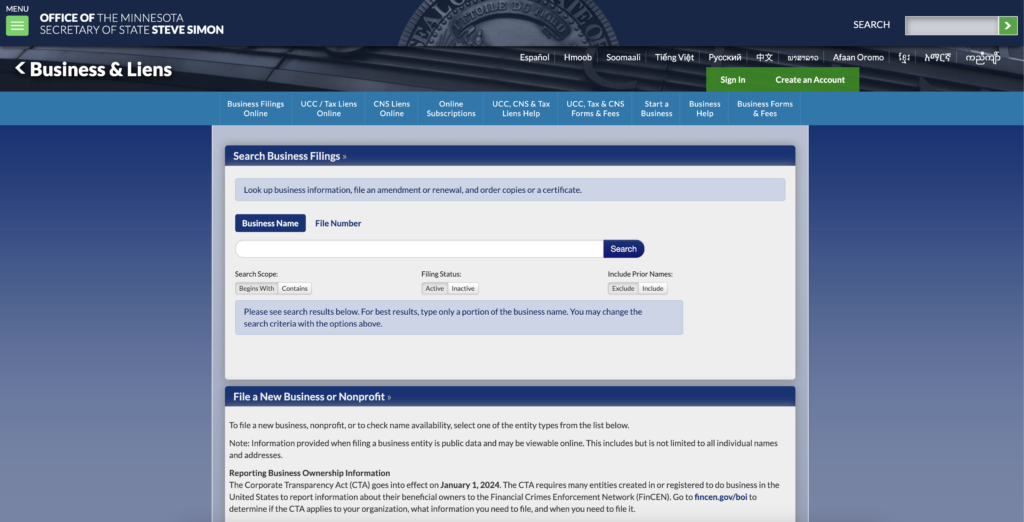

Step 1 – Go to the Business Filings Online page to get started.

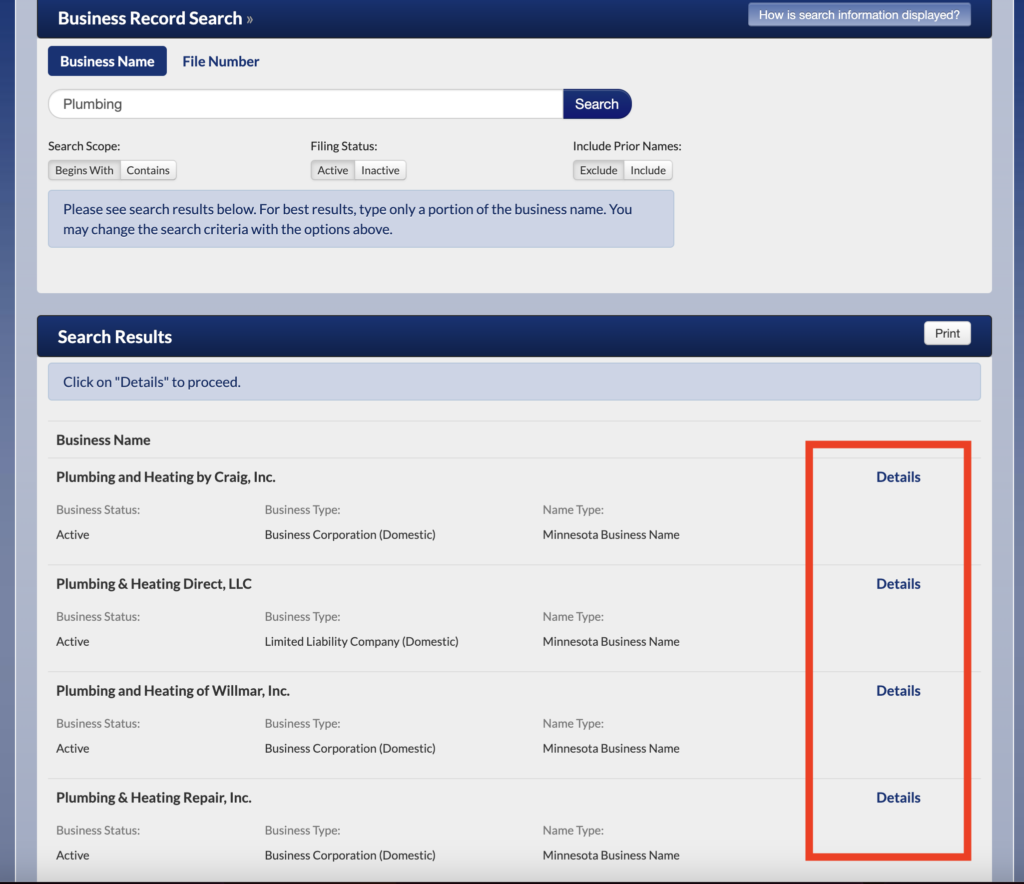

Step 2 – While there’s no option to search the database by a registered agent’s name, it’s possible to locate information about agents by searching for the entities they represent. Enter the entity’s name (or part of its name) and click “Search.” Click “Details” on the line associated with the entity.

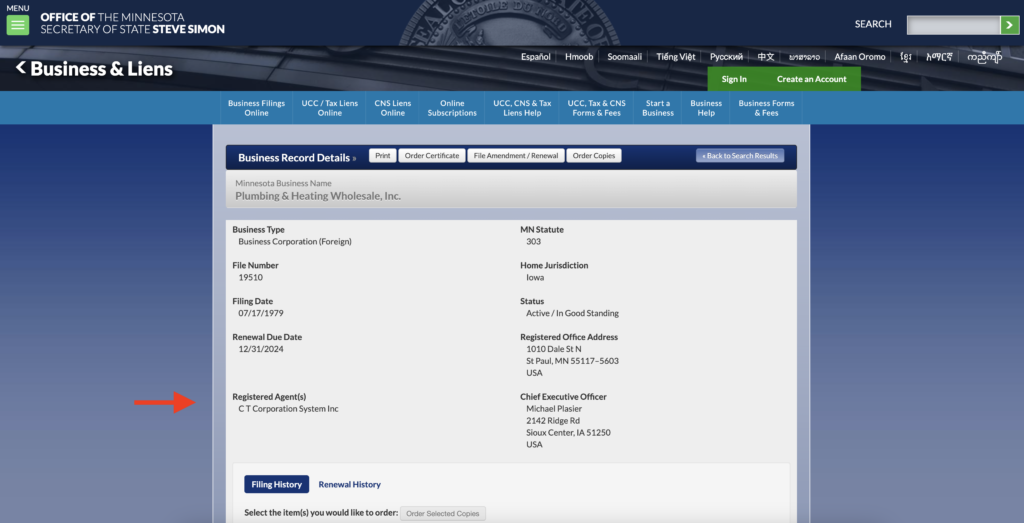

Step 3 – Review information about the entity, including the name of its registered agent.

Who can be a Registered Agent?

In Minnesota, a registered agent can be a natural person residing in the state, a domestic corporation or LLC, or a foreign corporation or LLC authorized to transact business in the state. The agent’s office address must be identical to the address of the corporation’s registered office.[2]

Can I be a Registered Agent?

The most common way for a corporation to select a registered agent is to include the agent in its formation document. To form an entity, select the appropriate form from the list below. Complete it and either mail or deliver the form, along with payment for the indicated filing fee, to the

Minnesota Secretary of State, First National Bank Building, 332 Minnesota Street, N201, Saint Paul, MN 55101. The fee schedule outlines all filing fees, plus fees for expedited processing.

The forms can also be filed online. Instructions for online filing are available on the Secretary of State’s website.

- Domestic Corporation: File Articles of Incorporation. The fee is $155 for in-person filing and $135 if mailed.

- Domestic Nonprofit Corporation: File Articles of Incorporation. The fee is $90 for in-person filing and $70 if mailed.

- Foreign Corporation or Nonprofit Corporation: File a Certificate of Authority to Transact Business in MN. The fee is $220 for in-person filing of documents for a profit-based corporation and $200 for in-person filing of documents for a nonprofit corporation. For filing by mail, the fees are $70 and $50, respectively.

- Domestic LLC: File Articles of Organization. The fee is $155 for in-person filing and $135 for filing by mail.

- Foreign LLC: File a Certificate of Authority to Transact Business in MN. The fee is $205 for in-person filing and $185 if documents are submitted by mail.

- Limited Liability Partnership: File a Statement of Qualification. The fee is $155 for in-person filing and $135 for filing by mail.

- Foreign Limited Liability Partnership: File a Statement of Qualification. The fee is $155 for in-person filing and $135 for filing by mail.

- Domestic Limited Partnership: File a Certificate of Limited Partnership (Minnesota). The fee is $120 for in-person filing and $100 for filing by mail.

- Foreign Limited Partnership: File a Foreign Limited Partnership Certificate of Authority. The fee is $120 for in-person filing and $100 for filing by mail.

Changing a Registered Agent

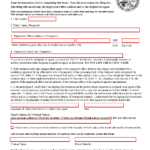

To change the registered agent, file a statement with the secretary that indicates the name of the business, its address, the names of the old agent and the new agent, and a statement that the change has been authorized by a resolution approved by the majority of the entity’s governing body.[3]

Notice of Change of Registered Office/Registered Agent

Download: PDF

Resigning as a Registered Agent

A registered agent may resign by filing a written notice of resignation with the Secretary of State. The notice must be accompanied by a signed statement verifying that notice of the agent’s resignation was given to the corporation. The resignation becomes effective 30 days after the notice is filed.[4]